90% of retail investors' myths about PE Ratio

PE Ratio as a valuation indicator should not be used too rigidly by investors.

Otherwise, you will not know how to workaround.

The following will explain many newbies’ myths or “superstitions” to PE ratio:

1) Many masters have said that stocks below PE 10 are cheap, and this is not wrong, but there are many blind spots.

If you only buy after watching PE 10 or less, you will lose a lot of investment opportunities,

Because PE 10 is just a guideline,

Rather than a religious doctrine or legal rule that you need to stick to.

The conclusion is that there is no certain number for the PE Ratio.

2) Taking PE Ratio as a whole is actually not a good strategy

Because it will ignore PE is actually an equation, composed of Price per share (share price) and Earning per share (profit).

The summary is to think and analyze the PE Ratio separately. The following will explain how to do it.

How to use PE Ratio to the fullest?

1. Measure market sentiment by country, industry PE

First, is the PE Ratio of a country’s stock market.

How to find the PE Ratio of a country's stock market?

In fact, it is measured by the stock market index of that country. You only need to search the index on the official website of Bloomberg. For example, in Malaysia, search for KLCI. At present (07/07/2020) KLCI's PE is about 20.27.

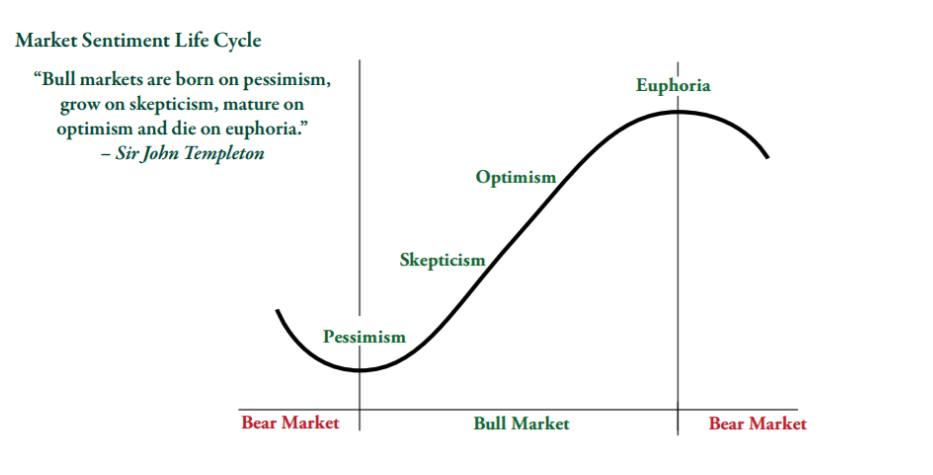

Investors who invest in foreign stock markets can often use this method to roughly measure whether the country is in a bull or bear market.

Previously, the stock market in China and Hong Kong was much lower than other countries such as the US (S&P 500 and Dow 30) due to trade wars. Some international fund organizations or investment groups will of course choose the seriously undervalued Chinese and Hong Kong stock markets if they follow a reverse investment strategy.

If you choose an industry, choose the underestimated industry first and find out the PE of the industry. If the PE in the industry is too much higher than the industry PE and there are no reasonable factors, you must pay attention to its risk (because the PE is not as low as Select the one with high PE).

2. Separate the PE Ratio

PE Ratio is composed of stock price and earnings per share,

The share price (Price Per Share) actually represents the investor's emotion.

Earnings per share (EPS) represents value.

What investors see on the Internet are past PEs, because earnings per share are about the past, not future.

We buy stocks in the hope that they will rise in the future, not the past. . .

The stock price represents sentiment, and many technical analysts often predict before the profit rises.

Because the stock market's response is always fast, there are always people behind the scenes who have bought the stock earlier than the retail investors know the news, causing the stock price to climb.

This is why many times before the results are released, the stock price will suddenly soar or plummet.

For example, construction stocks have fallen by 50% at an extremely fast rate. Now, even with a lot of bad news, it is difficult to see that the stock price fell actually because the stock price has already reflected that earnings will fall.

Buying stocks depends on the future-oriented EPS,

If the company’s future prospects are good, many profits have not been translated into profit,

Investors need to buy stocks one step at a time and enjoy the appreciation of stock prices while waiting for profitable realises.

3. High PE does not mean that the stock price will not rise

The nature of some industries is high PE,

Because investors maintain an optimistic attitude (sentiment) about the future of the industry.

As a result, the stock price soared and PE was high.

For example, the technology industry is the protagonist of this century, and the world knows that technology is the future,

Of course, the investors' emotions are optimistic, the stock price will be higher, and the PE will be higher.

(stock price represents an emotion, and profit represents value)

So back to the previous point, buy stocks must be pondered in the direction of EPS (Earnings Per Share),

Only then have the opportunity to catch growth stocks.

For example, companies like NESTLE and AMAZON, you look for the past PE, it is similar to the present, or even higher than now, but the stock price has been rising in the past few years because EPS has continued to grow.

So this is why some masters have created a more reasonable index, PEG Ratio.

Comments

Post a Comment